2021 ev tax credit rules

This is the right policy. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

Does your electric vehicle qualify for tax credit.

. The second document made further changes. The earned income tax credit also known as the EITC or EIC is a refundable tax credit for low- and moderate-income workers. If at least 50 of the battery components in your EV are made in the US.

500 EV Tax Credit. The rules state the federal electric tax credit only applies to road-going vehicles that are charged from external sources. One of the biggest and most talked-about new tax provisions for the tax year 2021 is the expanded 2021 Child Tax Credit.

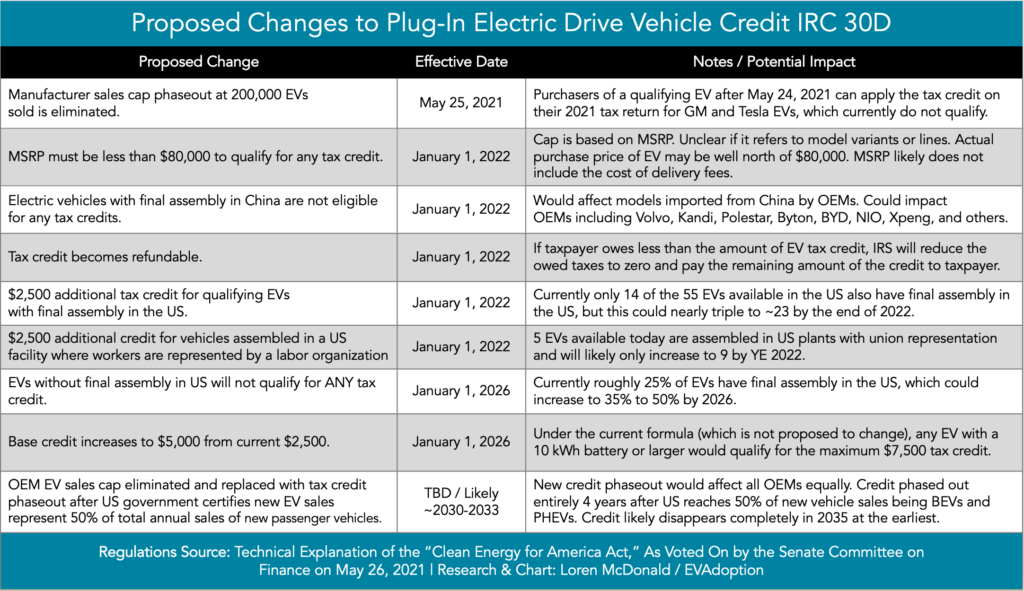

This would make the tax credit available again to buyers of EVs from Tesla and GM. The credit for qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021. They must contain battery packs that have capacities of 4 kilowatt-hours or greater.

The tax code should promote economically efficient decisions by limiting the number of distortionary provisions. The definition includes cars that are 100 battery-electric or have plug-in hybrid powertrains. In particular congressional Democrats and the White House have proposed that electric vehicle consumers receive a 12500 refundable tax credit if they purchase an EV made at an American factory.

Create an additional 2500 credit for union-made EV. EV vans trucks and SUVs with an MSRP of up to 80000 qualify increase from before. Place an 80000 price cap on eligible EVs.

Under the American Rescue Plan the Child Tax Credit. When you buy an electrified vehiclebattery electric vehicle BEV or plug-in hybrid electric vehicle PHEVmost people are entitled to a. The credit amount will vary based on the capacity of the battery used to power the vehicle.

The EV credit is regressive wasteful and distortionary tax policy that arbitrarily benefits one type of car over others. Theres also an income limit for taxpayers to receive the credit. 4500 EV Tax Credit.

For example if you can claim a 7500 tax credit but the amount you owe is only 5000 you will only be able to use 5000 of the available tax credit. However if you acquired the two-wheeled vehicle in 2021 but placed it in service during 2022 you may still be able to claim the credit for 2022. In previous years the maximum amount you could claim was 3000 for one child or 6000 for two or more.

Some other notable changes include. Create an additional 2500 credit for assembled in the US. Earned Income Tax Credit.

Businesses and Self Employed. 250000 for single people. The credit may also be increased to a maximum of 12500.

Small neighborhood electric vehicles do not qualify for this credit but they may qualify for another credit. If your EV was made in the US with a union workforce. The proposed 12500 electric vehicle tax credit would include 4500 for EVs built in the United States by union workers effective after 2027.

You cannot claim a tax refund through the electric vehicle tax credit. The proposed eligibility requirements for the EV tax credit are simple. During 2021 the US.

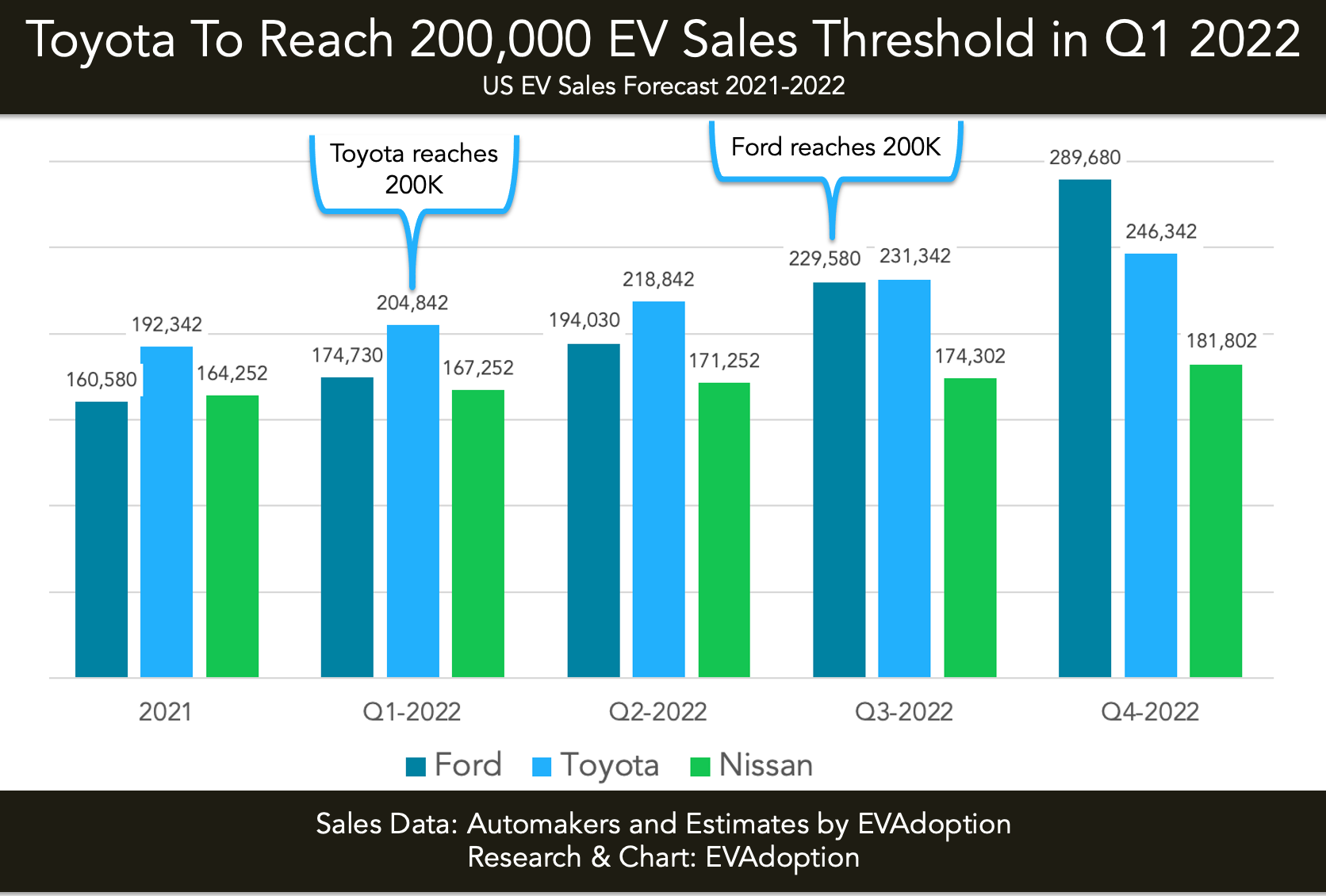

The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. The amount of tax credit you can claim depends on how much you owe in taxes as this is a non-refundable tax credit. The manufacturer sales cap phaseout at 200000 EVs sold is eliminated effective May 24 2021upon passing of legislation.

Cars need to be under 55000. A refundable tax credit is not a point of purchase rebate. 16 rows There is a federal tax credit of up to 7500 available for most electric cars in 2021.

Senate through a non-binding solution has approved a 40000 price threshold on qualifying electric cars that would be eligible for a 7500 federal tax credit. For 2021 expenses you can claim up to 8000 for one child or dependent and up to 16000. President Trumps Fiscal Year 2021 budget proposal calls for repeal of the Electric Vehicle Tax Credit.

Start date Jun 19 2021. You must have purchased it. State andor local incentives may also apply.

For the 2021 tax year the earned income credit ranges from 1502 to 6728 depending on tax-filing status income and number of children. The effective date for this is after December 31 2021. You may be eligible for a credit under Section 30D a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. And the OEM phaseout is retroactive to May 24 2021 so buyers of Tesla and GM EVs purchased after May 24 2021 could apply the credit on their 2021 tax return. 2021 EV Tax Credit.

IRS or Federal Tax Credits by manufacturer for New All-Electric EV andor Plug-in Hybrid Vehicles. Other federal tax credit rules to note as an electric vehicle owner. Jun 19 2021 1 Jun 19 2021 1.

May 31 2021 12 55 USA. Democrats plan boosts EV tax credit eligibility to pricier trucks SUVs Nov. 500000 for married couples.

Do not report two-wheeled vehicles acquired after 2021 on Form 8936 unless the credit is extended. As it stands the credit provides up to 7500 in a tax credit when you claim an EV purchase on taxes filed for the year you acquired the vehicle. 2021 Child Tax Credit.

Non-cars vans trucks SUVs need to be under 80000 to be eligible for the credit.

Latest On Tesla Ev Tax Credit January 2022

Legislation Regulations Evadoption

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Bmw Ev Tax Credit What Bmw Cars Qualify For Ev Federal Tax Credit

Ev Tax Credit Calculator Forbes Wheels

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption